“If you’re looking for an insurance policy against volatility and economic uncertainty, gold is a great way to go…the whole point of diversification is to be prepared in case something goes wrong and your thesis doesn’t pan out.” -Jim Cramer, CNBC

“Say, answer me this, will ya? Why’s gold worth some twenty bucks an ounce? ” -Howard (Walter Huston), “The Treasure of the Sierra Madre” (1948)

In a world of zero inflation, negative interest rates, and trade friction, gold so far has had a banner 2019. Our proxy is Engelhard industrial bullion. Between January 1 and August 31, one troy ounce has gone from $1,283.83 to $1,528.00, an advance of over 19%. As surely as night follows day, many early-year naysayers have jumped on board, and talk of $2,000 and above has started to percolate. Maybe; but, we try never to get too carried away, and instead, like to focus on why an asset class does or does not belong in our clients’ portfolios. In this case, the asset class does belong, specifically as an honored component of our Total Portfolio Management (TPM) and Indexed Total Portfolio Management (ITPM) strategies. Why gold?

Humankind has had a fascination with and a reverence for the barbarous relic since about the time our ancestors discovered fire. Since then, gold has been used to adorn ears, necks, wrists, clothing, etc.; gold has been used to cap teeth; gold has been used in numerous industrial processes; gold has been used to treat disease; and, gold in an investment sense has been used as an alternative to fiat currencies and as a store of value. For these purposes, let’s focus on gold in the monetary/investment world of the modern era, and start with something called Executive Order 6102.

Gold in the Monetary World – A Brief History

The year was 1933, and the Great Depression was raging. More than one economist, along with FDR and many others in Washington, believed that gold was being hoarded, thereby stalling growth and prolonging the agony. The solution: Executive Order 6102, which called upon all U.S. citizens to deliver on or before May 1 almost all of their gold coins, bullion, and certificates in exchange for $20.67 per troy ounce. Of course, jewelers, dentists, and some others were exempted, however, the Order clearly freed up a lot of the public’s long-held stash. One big problem was that Treasury gold for international transactions subsequently was raised to $35 per ounce, so all of those law-abiding citizens who had surrendered their gold suffered an immediate loss of over $14 per ounce. Then, along came the Gold Reserve Act of 1934, which, among other things, changed everybody’s official exchange rate to $35. That’s where it stayed until the so- called Nixon Shock, when things really started to unravel.

The Nixon Shock of August 15, 1971, was a major policy enactment in response to 1970’s 6% inflation rate, a worsening trade balance with our partners, and accelerating demand for Treasury gold in exchange for overseas dollars. Wage and price controls, the economics equivalent of bleeding as a cure for disease, were slapped on the American economy for 90 days, and, right out of the Smoot-Hawley playbook, a 10% surcharge was levied on all imports. And, the gold window was closed, thereby ending the convertibility of overseas dollars into gold. The latter move, of course, ended anything like a fixed value for gold, and subsequently, Gerald Ford signed mid-70s legislation legalizing gold’s ownership (as of December 31, 1974). By then, of course, the real market price was far above $35 per ounce. In fact, the Engelhard industrial bullion quote of that date was $182. Still, gold went on to enjoy a very prosperous five-year run as this now-freely traded asset reached $512.40 per ounce on December 31, 1979.

Catch-up time in the 70s, but how has gold done over time?

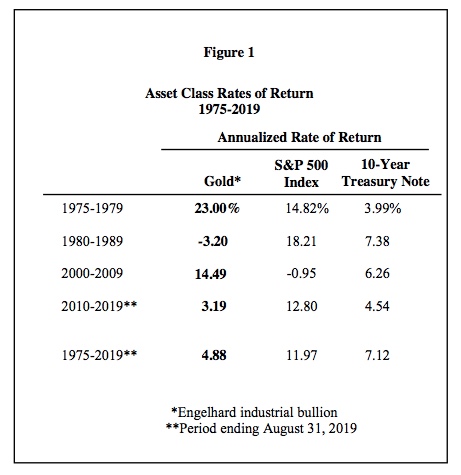

Take a look at Figure 1. The Hallelujah 70s were followed by, as we in the investment business say, “sub-par results” in both an absolute sense and relative to both U.S. common stocks and a long-dated Treasury bond. Why? Well, according to all the learned treatises, nothing stirs up the price of gold quite like economic calamity and particularly inflation, and there was no economic calamity or inflation during the healthy Reagan/Bush/Clinton growth years. But, what about the 00s? They hardly prove the reverse. Gold had a very good decade, but once again, there was no inflation. Economic calamity? There was the early-decade dot.com bubble and aftermath, however, “economic calamity” is something of a stretch. Later on, the Financial Crisis of 2008- 2009? That qualifies, but gold’s reputation as a safe haven toward which everyone runs during such times is not supported by the 2008-2009 facts. More specifically, gold was essentially flat over the period of maximum nail-biting, say, mid-2008 until March 2009. That’s a lot better than the equity market did, but no, all the running was in the direction of another market…Treasuries. The 10s? As usual, some adventure; but, no real economic calamity, and clearly, no inflation. The price of gold increased all of 14% in the decade’s first nine years, and then, as mentioned, 19% in this year’s first eight months.

So, where does that leave us? Combining the catch-up 70s with the decidedly ho-hum 80s and 90s, and then tacking on the very gold-friendly 00s and somewhat-friendly 10s, we get a 45-year annualized return of 4.88%, less than half the return of the S&P 500 Index and considerably less than the return from a long-dated Treasury bond.

Humphrey Bogart and Walter Huston went all the way to the Sierra Madre for 4.88% per year? Why own gold?

Two reasons, and the first is quantitative. The performance of gold does not correlate very well with the performance of the two traditional financial asset classes: equities and fixed income securities. That goes for the entire 45-year period, as well as most sub-periods of any length. This lack of correlation, of course, means that gold brings some diversification firepower to the party, and the result is a less volatile pattern of total portfolio investment returns. Hence, gold is a stabilizing component.

But, the “good diversifier” label means nothing if we’re talking about a depreciating asset/asset class or one with generally poor prospects. Such does not appear to be the case with gold, and that is the second reason to own it. As stated, accelerating inflation, i.e., too many dollars chasing too few goods, and let’s call it “currency trauma” in general tend to support a rising gold price. And, while a lot of slack in the worldwide economy suggests that inflation is not just around the corner, the many attempts to eliminate that slack over the past few years have produced a lot of paper currency out there, particularly dollars.

Gold…good diversifier, decent prospects.

How much and how?

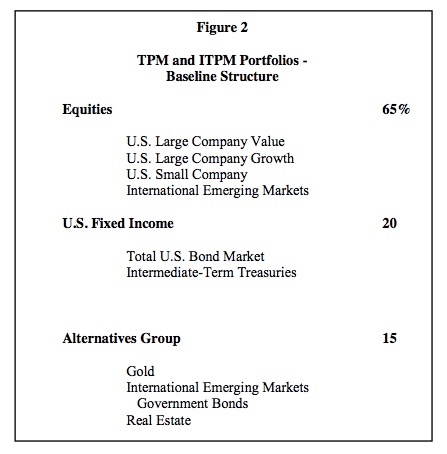

Gold’s policy weighting in all of our TPM and ITPM portfolios is 5% (see Figure 2; the three components in a TPM or ITPM Alternatives Group are equal-weighted). This is hardly a policy bet that will produce great wealth or save a sinking ship. This is a policy bet that will benefit the portfolio in one type of economic environment. That’s what intelligent investing is all about, isn’t it? Intelligent investing is the art of combining several assets or asset classes, all of which do well in a different type of economic environment. Of course, if we knew the future with certainty, we would buy the asset or asset class most in tune, and go to sleep. But, we never have that luxury. One of the Fundamental Beliefs underlying TPM and ITPM is that the future is unpredictable and diversification is very important. Gold at 5% makes sense in a well-diversified portfolio structure.

How to own gold? That used to be a considerable challenge. Scalability was a problem with coins; weight (and therefore, transportability) was a problem with ingots of any size; transaction costs, purity concerns, and secure storage were problems with both. Along came Exchange- Traded Funds (ETFs), and many of these problems went away. All at once, gold could be bought and sold in size throughout the trading day, at commission levels comparable to equity trades. Transportability, storage of the asset, and the continual evaluations of its purity became the responsibility of the ETF’s sponsor. Of course, none of that came free of charge, but the Funds’ expense ratios were and continue to be far from exorbitant. The only caveat – and we preach this to our TPM and ITPM clients all the time – is that ETF shares must be backed by physical gold. If the gold ETF is designed only to track the price of gold, we are not interested.

Five percent of total portfolio assets; gold ETFs backed by physical gold.

**************

One of the most-asked client questions around here is: “Should I own gold?” Yes, you should, at about the 5% level. Let’s summarize a few more thoughts on the barbarous relic.

First, gold has stirred our emotions since men and women began walking upright. Always fascinating and mystical, always revered, frequently the basis for conflict.

Second, in the 1930s, the hoarding of gold was considered a Depression-prolonging villain by FDR et al., and gold’s ownership was severely restricted for decades, as a direct result. That came to an end on December 31, 1974, when Americans once again could own gold for investment purposes and the final nail was driven into the old fixed exchange rate coffin.

Third, from that date until the end of August 2019, gold (Engelhard industrial bullion) provided an annualized investment return of 4.88%, comfortably ahead of inflation but below the return provided by U.S. equities and long-dated Treasuries. And, the advance has been far from straight-line. The 70s were just fine; the 80s and 90s far from it; the 00s very rewarding; the 10s kind of rewarding.

Fourth, gold may have been moving in fits and spurts, but those fits and spurts have not correlated well with the fits and spurts of U.S. equity or Treasury prices. Gold is a diversifying asset class.

But fifth, a good diversifier with poor prospects doesn’t quite cut it. With gold, on the other hand, the metal’s prospects in a world trying very hard to inflate its way back to prosperity seem to be well above-average.

And finally, the virtues of ETFs as a way to own gold are considerable. The shares of gold miners? Clearly, the price of gold is a large factor in their performance, however, there are other factors, e.g., overall stock market health and its causative factors. For this and other reasons, we prefer to own the metal – we know exactly what we are getting.

Make no mistake, we continue to be positive regarding U.S. equities, for a number of well- considered, quantifiable reasons. The bond market? Not so much, but that doesn’t mean bonds of a certain kind don’t have a place in a well-diversified portfolio. They do because bonds will (continue to) do well in a certain kind of economic environment.

Same with gold, and owning it at the 5% level never has been easier.